STAFF REPORTER

ISLAMABAD: According to the World Bank’s Enterprise Survey 2022, only 18% of Pakistani firms import inputs from abroad, significantly lower than the global average of 62%. The study also highlights that South Asian firms import inputs at a higher rate of 35% compared to Pakistani firms. Importing supplies or inputs from foreign countries can enhance exports and improve productivity, particularly for manufacturing and IT-related firms. However, the report emphasizes the need for imported inputs to add value to the final products to have a positive impact.

The majority of input imports in Pakistan come from the manufacturing sector, with 18% of manufacturing firms importing materials or supplies from foreign countries, while only 8% of services sector firms do the same. Among the manufacturing sector, non-metallic mineral product businesses lead in importing inputs, followed by motor vehicles and transport equipment, and the chemical products industry. These imports can help these industries create higher quality products and contribute to exports.

The survey also reveals that Pakistani firms that are exporters are more likely to import material inputs of foreign origin, making up 46% of the surveyed firms, three times more than non-exporting firms. Exporting firms also have a higher percentage of total inputs that are imported, indicating the need for quality assurance protocols. This highlights the potential benefits of importing inputs to improve product quality for export-oriented businesses.

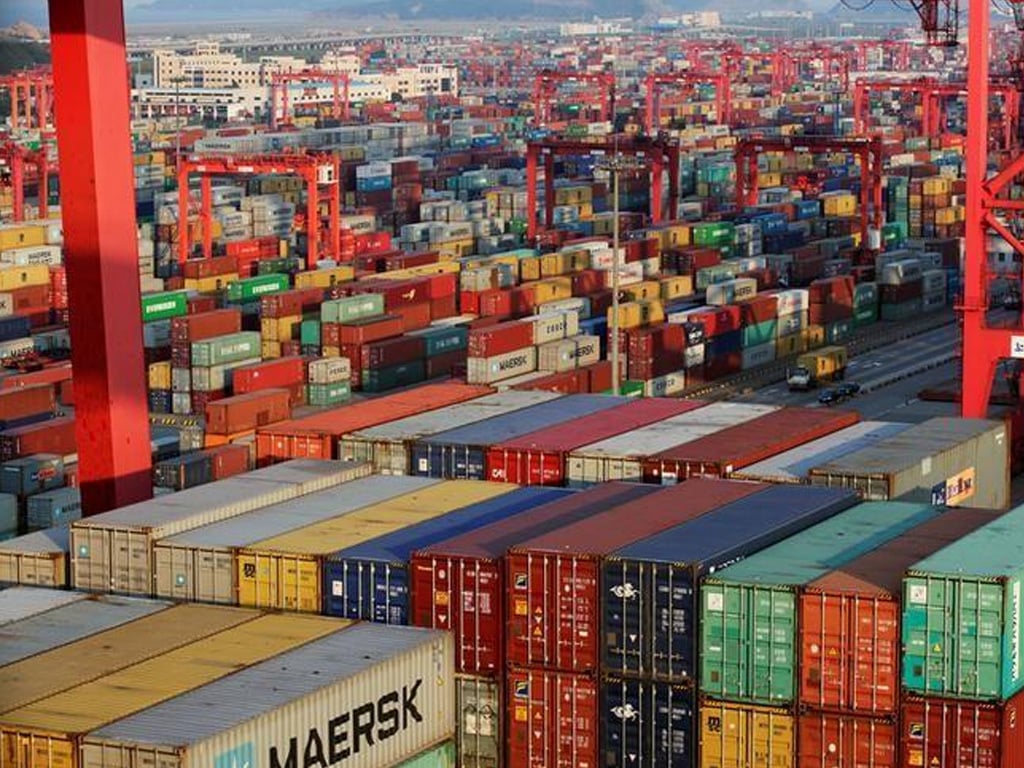

In terms of trade constraints, 15% of Pakistani firms identify customs and trade regulations as a major obstacle. The manufacturing sector, in particular, is significantly affected, while the services sector is less concerned about this issue. Similar patterns are observed in South Asia and the global perspective, with manufacturing firms expressing more dissatisfaction with customs and trade regulations compared to the services sector.

Pakistani firms face longer waiting periods for clearing imports and exports by customs compared to South Asia and the global average. It takes 17 days to clear imports and 19 days to clear exports in Pakistan, which is higher than both South Asia and the global average. Reducing the time taken for customs clearance can enhance trade efficiency and benefit businesses, especially those dealing with non-durable and perishable goods.

The survey reveals that 5% of sales from Pakistan are directly exported, higher than South Asia’s 4% but slightly lower than the global proportion of 6%. This indicates a demand for Pakistani products in the global market. To capitalize on this, simplifying the legislative process for exporting is recommended.

It’s important to note that these figures may vary when considering the agricultural sector’s imports and exports. Agricultural products may have easier exportability due to their perishable nature but can face delays due to quality control issues. Furthermore, focusing on facilitating international trade in the manufacturing and services sectors through policy measures and reducing bureaucratic hurdles can unlock further growth opportunities for Pakistani businesses in the global market.